related courses

- Certificate in Advance Excel (CAE)

- Certificate in Smart Typing (CST)

- Certificate in GST Using Tally Prime (C-GST)

- Workshop (Excel Using AI)

- Certificate in Basic Computer (CBC)

- Google Sheet

- Spoken English

career counselling

book 1

book 2

book 3

book 4

book 5

book 6

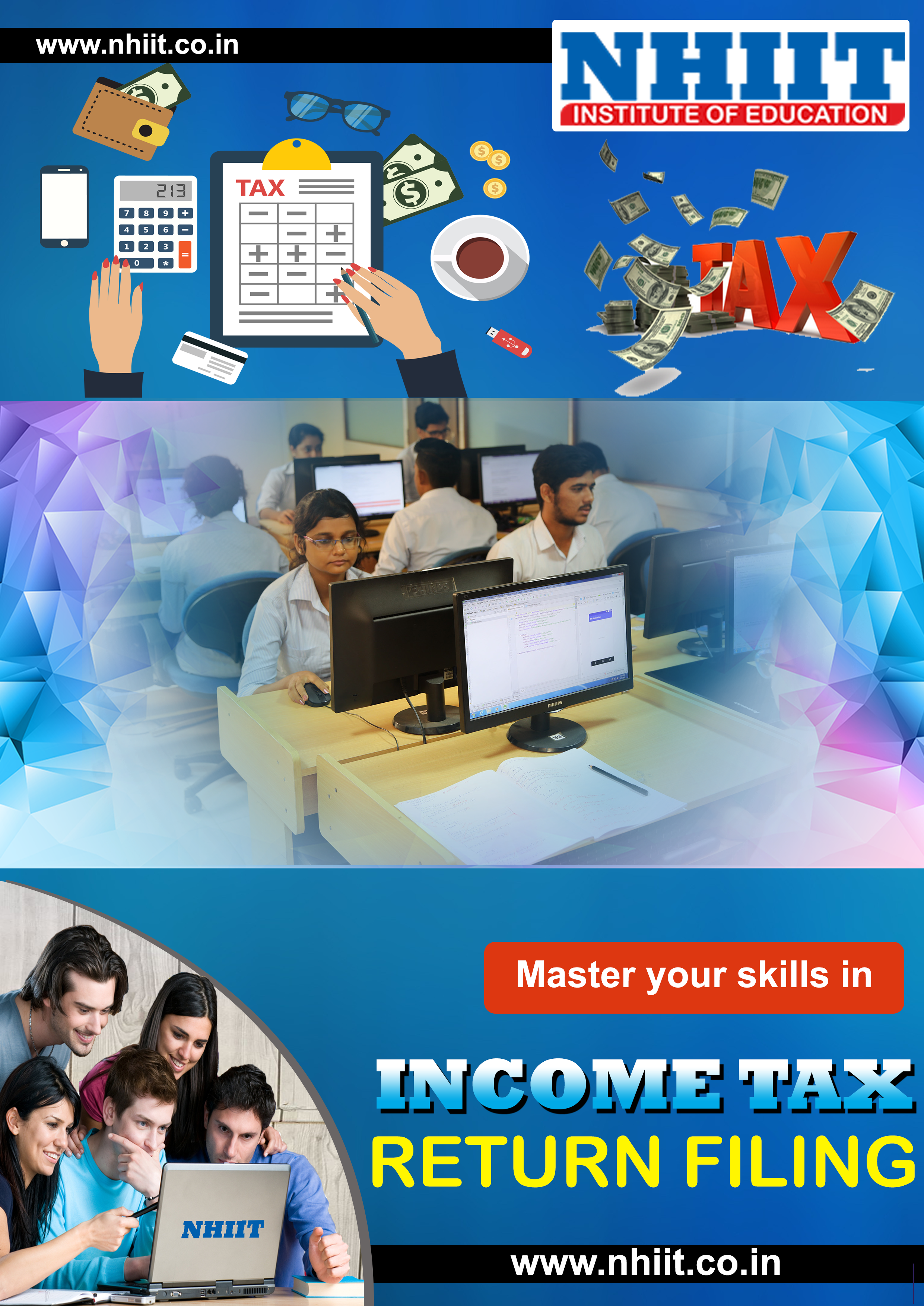

about course

Streamline your finances with our e-filing and taxation services. Expert preparation and filing, maximum refunds, and compliance guaranteed. Outsourcing tax needs saves time, reduces errors, and frees you to focus on coaching. Accurate, timely, and personalized service for peace of mind. Trust us to handle your financial reporting and tax requirements.

learning outcome

- You’ll be able to File taxes accurately and on time.

- You’ll be able to Claim maximum refunds and deductions.

- You’ll be able to Tax preparation and planning.

- You’ll be able to Reduced penalties and fines.

course highlights

| Duration | 4 Months or 16 Classes |

| Free books | 1 Books as Study Material |

| Examination | Online |

| Certification | Digital & Hard Copy |

| Prerequisites | Basic Computing |

software that you will learn in this course

course content

- Introduction of Income Tax

- Computation and Filing of ITR-01

- Computation and E Filing of ITR-02 ( Income from House & Property )

- Computation and E Filing of ITR-02 ( Income from Capital Gain & Agriculture )

- Computation & E Filing of ITR-03

- Computation of Presumptive

- income & E Filing of ITR-04

- E Filing of Partnership Firm : ITR-05

- E Filing of Companies Return : ITR-06

- Online Registration for PAN

- Introduction of Taxation in India

- Payment to other than Salary Return 26Q

- TDS Return Form 26Q

- Salary Components with Payroll

- Continue next Para.....

- TDS Return Form 24Q

- Tax Collection at Sources

- Payment to Non-Resident 27Q

- About Traces Website

- Interest & Penalty

- TDS on Property & Rent

- TAN ( Tax deduction & collection )

- Introduction of Goods & Services Tax (GST)

- Structure of GST

- Invoicing in GST

- Input Tax Credit & Payment in GST

- GST Return Filing

- Composition Scheme Under GST

- Reverse Charge Mechanism (RCM)

- E-Way Bill under GST

- Registration under GST

- Professional Tax, ESI & PF

- Tax Form Download, Fill up & Upload

jobs You’ll get after completing the course

Unlock exciting career opportunities after completing our e-filling and taxation course! Secure jobs as Tax Consultants, Financial Advisors, Accounting Assistants, or Bookkeepers. Work with top firms, coaching centers, or start your own practice. Enjoy roles in tax preparation, auditing, financial planning, and more. Boost your employability and earning potential with our comprehensive training and certification.

job profileafter completing this course |

average salary( 1+ year experience ) |

|---|---|

| Tax Accountant | 36k - 94k |

| Income Tax Advisor | 36k - 94k |

| Tax Analyst | 36k - 94k |

| Inventory Manager | 30k - 64k |

| GST practitioner | 38k - 117k |

features & facilites

backup class

backup class

frees installment

frees installment

100% job assistance

100% job assistance

live project

live project

flexible timing

flexible timing

expart trainer

expart trainer

free library

free library

practical larning

practical larning